Ethos Reserve

Ethos Reserve is a decentralized borrowing protocol that allows users to draw interest-free loans against assets used as collateral, paid in Ethos Reserve Notes (ERN).

In addition to the collateral, loans are secured by a Stability Pool containing $ERN and by fellow borrowers collectively acting as guarantors of last resort.

Ethos documentation is currently under development and will be linked here when it is live.

Ethos Reserve is fully audited by Certik, with additional audits and bounties currently live.

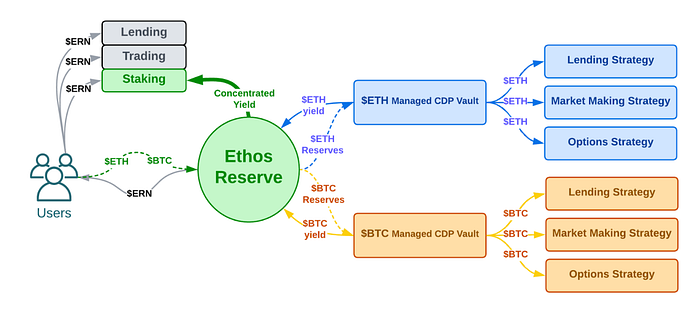

Managed Collateralized Debt Position (CDP) Vaults

Ethos Reserve is designed to deploy its underlying assets to DeFi yield strategies, as well as manage their risk and liquidity. Users can enjoy highly efficient $ERN loans while deposited assets are put to work in the lowest-risk environment possible. Yield generated by the protocol is directed back to $ERN stakers, who also benefit from liquidation income. This system allows the protocol to take advantage of Ethereum’s low-risk interest rates, resulting in a DeFi system that has the network effects of a liquid staking derivative with highly efficient lending and stable-asset yields built in.

Multi-Collateral Debt Management

Ethos Reserve manages debt with highly complex data structures that allow the protocol to isolate and liquidate multiple collateral types more efficiently than competitors. Assets can be redeemed directly from the protocol, ensuring that users have a right to their assets no matter the state of market liquidity. This combination of features allows for extremely high LTV ratios and additional yield for users. It also removes the need for market-making, as the protocol will always swap under-peg tokens for collateral.

Self-Contained, 0-interest lending

Ethos Reserve issues interest-free loans denominated in $ERN. Instead of paying interest, users pay a small issuance and redemption fee, which is directed to $bOATH (Bonded $OATH) stakers. This means that users do not need to worry about micro-managing their position and the protocol does not need to worry about bad debt piling up. Issuance and redemption fees also allow $bOATH stakers to derive value from arbitrage and $ERN volatility.

bOATH

Bonded Oath, or $bOATH, is both OATH and ETH, backed by a Balancer-powered 80/20 liquidity pool. $bOATH earns platform fees and benefits from trading fees generated by Ethos’ incentive buyback and distribution strategies. These strategies create a constant source of demand for $OATH as it buys it back to fund yield.

$bOATH benefits from any Balancer liquidity incentives, trading fees, and Ethos Reserve's issuance and redemption fees.

Additional resources:

You can learn more about Ethos Reserve in this article.

Last updated